Recent evidence suggests that inflation in Europe and the US is on a downward path. The US Consumer Price Index (CPI) recorded the lowest monthly inflation print since mid-2020. Despite this, interest rates remain at or near their peak in the US and the Eurozone.

Central banks have shifted away from forward guidance, focusing instead on data. In the US, policymakers are confident that inflation will return to target by the end of next year and have signalled potential cuts in the currently restrictive short rates in the second half of this year. Similarly, the European Central Bank remains data dependent. Policymakers cut interest rates by 25 basis points in June, reflecting increased confidence that inflation will fall sustainably to target.

Bond markets have been volatile due to mixed economic activity and inflation data. Following sharp declines in Q4 2023, this year has continued to see swings contingent on economic news. Overall, yields are somewhat higher than at the start of the year.

Equity markets have shown resilience, buoyed by continued economic growth, positive returns, inflationary pressures, and advancements in AI, with the US market leading the way amid central bank rate uncertainties. US and Japanese equities have delivered strong year-to-date returns. Larger companies led performance, while small-cap stocks and REITs underperformed. Technology and AI-related stocks were standout performers, particularly in the US and Taiwan, driving robust gains. US valuations continue to reflect expectations of strong earnings growth over the next five years, extrapolating the earnings outperformance of US companies since the Global Financial Crisis.

Credit spreads remain tight relative to historical levels across major regions, despite a slight uptick in June. Current spreads imply a below-average level of defaults relative to historic averages, especially after significant declines in high-yield spreads earlier in the year and the last three months.

Most currencies have depreciated against the US dollar this year. The biggest mover has been the Japanese yen, which has fallen over 12% year-to-date, including approximately 2.5% in June. Other major currencies have seen smaller movements.

Political events and elections are increasingly driving market movements. In the US, presidential debate outcomes have influenced bond yields, while in Europe, the French snap election has added volatility to returns and the overall outlook. Considering the ongoing wars in the Middle East and Ukraine, geopolitical risks remain high.

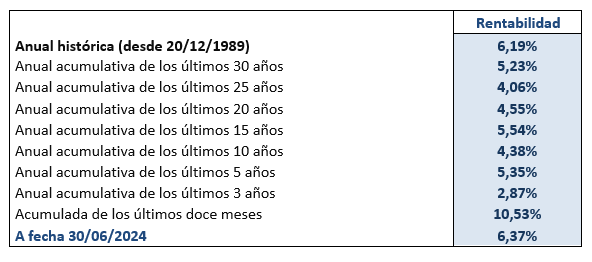

The Caixa 2 F.P. Pension Fund has achieved a positive return of +6.4% up to the end of the second quarter of this year.

Additionally, it has surpassed its investment target (Euribor 3 months + 3.5% annualized over 5 years) with an annualized return of 5.3% over 5 years, exceeding its target of 4.4% by 90 basis points. The fund has also outperformed inflation, which was 3.5% for the same period.

A detailed analysis of the various assets in the Caixa 2 F.P. portfolio reveals positive contributions from alternative credit and equity categories. However, bonds and other alternative investments showed an overall negative contribution. Combined with the adverse effects of currency hedging, this resulted in a year-to-date alpha of -0.1% relative to the management objective.

Finally, compared to the market for Employment Tax Qualified Pension Funds, the Fund ranks among the top 5% of the best funds in Spain over 5 and 10 years and among the top 25% over 1 and 3 years, as of June 2024.

In summary, Pensions Caixa 2, F.P. emerges as a highly attractive investment option for its participants, with performance meeting its targets and achieving strong profitability.